How to Track FintechZoom QQQ Stock Trends1

In the ever-evolving landscape of finance and investing, staying informed about the latest trends and tools is crucial for making well-informed decisions. One such tool that has garnered attention in recent times is FintechZoom. In this comprehensive guide, we’ll explore how FintechZoom QQQ Stock can be used to analyze and make informed decisions about QQQ stock. Whether you’re an experienced investor or just getting started, understanding the intersection of fintech platforms and popular investment vehicles like the QQQ ETF can provide valuable insights into your investment strategy.

Understanding FintechZoom

What is FintechZoom QQQ Stock?

FintechZoom is a cutting-edge financial technology platform designed to provide comprehensive insights and analytics on various financial instruments. From stock market trends to detailed company analyses, FintechZoom aims to empower investors with the data they need to make informed decisions. The platform leverages advanced algorithms and data analytics to deliver up-to-date information on financial markets, news, and trends.

Key features of FintechZoom include:

- Real-time Market Data: Access to real-time stock prices, indices, and forex rates.

- Detailed Company Profiles: In-depth analysis of individual companies, including financial statements, earnings reports, and key metrics.

- Investment Insights: Analysis and recommendations on various investment opportunities, including stocks, ETFs, and cryptocurrencies.

- News and Updates: Latest news and updates related to financial markets and economic trends.

What is QQQ Stock?

An Introduction to QQQ

QQQ, officially known as the Invesco QQQ Trust, is an exchange-traded fund (ETF) that aims to track the performance of the NASDAQ-100 Index. The NASDAQ-100 Index includes 100 of the largest non-financial companies listed on the NASDAQ Stock Market, making QQQ a popular choice for investors seeking exposure to technology and growth-oriented stocks.

Key characteristics of QQQ include:

- Technology Focus: The ETF is heavily weighted towards technology and innovation-driven companies, including major players like Apple, Microsoft, and Amazon.

- Growth Potential: Due to its focus on tech and growth stocks, FintechZoom QQQ Stock has the potential for significant capital appreciation, though it can also be subject to higher volatility.

- Diversification: As an ETF, QQQ provides diversification across a broad range of sectors within the NASDAQ-100, reducing the risk associated with investing in individual stocks.

Analyzing QQQ Stock with FintechZoom QQQ Stock

Leveraging FintechZoom for QQQ Analysis

FintechZoom QQQ Stock provides a wealth of tools and resources that can enhance your analysis of QQQ stock. Here’s how you can use FintechZoom to gain deeper insights:

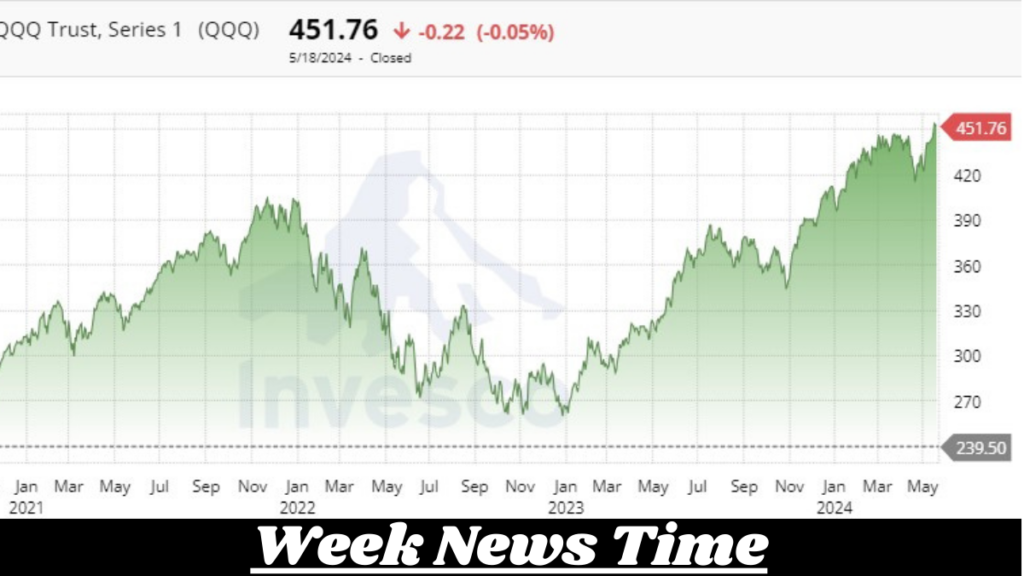

1. Real-Time Data and Charts

FintechZoom offers real-time data and interactive charts for QQQ stock, allowing you to monitor its price movements and technical indicators. By analyzing these charts, you can identify trends, support and resistance levels, and potential entry and exit points.

2. Company and ETF Profiles

FintechZoom provides detailed profiles of the companies within the QQQ ETF. This includes financial metrics, earnings reports, and recent news. Understanding the performance and outlook of individual companies can give you insights into the overall performance of QQQ.

3. News and Market Sentiment

Stay updated with the latest news and market sentiment related to QQQ. FintechZoom QQQ Stock aggregates news from various sources, helping you stay informed about developments that could impact QQQ’s performance, such as technological advancements, regulatory changes, or economic indicators.

4. Investment Insights and Recommendations

FintechZoom QQQ Stock offers investment insights and recommendations based on its data analysis. These insights can help you evaluate whether QQQ aligns with your investment strategy and risk tolerance. Pay attention to expert opinions and market forecasts to make well-informed decisions.

Key Factors Affecting QQQ Stock

1. Technology Sector Trends

Since QQQ is heavily weighted towards technology stocks, trends within the technology sector play a significant role in its performance. Innovations in areas such as artificial intelligence, cloud computing, and cybersecurity can drive growth for the companies within QQQ.

2. Economic Indicators

Economic indicators, such as interest rates, inflation, and FintechZoom QQQ Stock growth, can impact QQQ stock. For example, rising interest rates can affect technology stocks negatively, while strong economic growth can boost investor confidence and drive up stock prices.

3. Corporate Earnings

Earnings reports from the major companies within FintechZoom QQQ Stock are crucial for its performance. Strong earnings results can lead to positive price movements, while disappointing results can cause declines. Keeping track of earnings announcements and analyzing their impact on QQQ is essential.

4. Market Sentiment

Overall market sentiment, including investor confidence and geopolitical factors, can influence QQQ stock. Positive sentiment towards technology and innovation can drive up prices, while negative sentiment or market corrections can lead to declines.

Strategies for Investing in QQQ Stock

1. Trend Following

One popular strategy for investing in QQQ is trend following. By analyzing historical price movements and technical indicators, you can identify trends and make buy or sell decisions based on these trends. FintechZoom’s real-time data and charts can assist in implementing this strategy.

2. Fundamental Analysis

Conducting fundamental analysis involves evaluating the financial health and growth potential of the companies within QQQ. By using FintechZoom’s company profiles and financial metrics, you can assess the overall strength of the ETF and make informed investment decisions.

Benefits and Risks of Investing in FintechZoom QQQ Stock

Benefits

- Growth Potential: QQQ offers exposure to some of the fastest-growing technology companies, providing the potential for significant capital appreciation.

- Diversification: As an ETF, QQQ provides FintechZoom QQQ Stock across multiple tech companies, reducing the risk associated with individual stock investments.

- Liquidity: QQQ is a highly liquid ETF, meaning you can easily buy and sell shares without significantly affecting the price.

Risks

- Volatility: Due to its focus on technology stocks, QQQ can be subject to higher volatility and price fluctuations.

- Sector Concentration: The heavy weighting towards technology can lead to performance fluctuations based on tech sector trends and economic conditions.

- Market Risk: Broader market conditions and economic factors can impact QQQ’s performance, leading to potential declines in value.

Conclusion

FintechZoom and QQQ stock represent powerful tools for investors looking to navigate the complex world of finance and investment. By leveraging FintechZoom QQQ Stock advanced analytics and staying informed about the factors affecting QQQ, you can make more strategic investment decisions and potentially enhance your returns.